The Road Map to Achieve Your Financial Future

LEARN what you MUST know

to make SMART decisions.

Upcoming seminars at the Long Beach Real Estate Resource Center:…

ContinueAdded by Jennifer Griner on August 11, 2010 at 3:46pm — No Comments

Government OKs $600 Million in Housing Aid for 5 States

The Obama administration plans to send $600 million to help unemployed homeowners avoid foreclosure in five states.

The Treasury Department said Wednesday that mortgage-assistance proposals submitted by North Carolina, Ohio, Oregon, Rhode Island, and South Carolina received approval. The states estimate their efforts could help up to 50,000 homeowners.

The administration is directing $2.1… Continue

Added by Jennifer Griner on August 10, 2010 at 10:02am — No Comments

Low Cost Ways to Spruce Up Your Home Exterior

Make your home more appealing for yourself and potential buyers with these quick and easy tips:

1. Trim bushes so they don’t block windows or architectural details.

2. Mow your lawn, and turn on the sprinklers for 30 minutes before the showing to make the lawn sparkle.

3. Put a pot of bright flowers (or a small evergreen in winter) on…

Added by Jennifer Griner on August 9, 2010 at 10:19am — No Comments

Do Not Overlook these Items on a Final Walkthrough

It is an exciting time when everyone is ready to finally close the deal on your new home.

It’s guaranteed to be hectic right before closing, but you should always make time for a final walk-through. Your goal is to make sure that your home is in the same condition you expected it would be. Ideally, the sellers already have moved out. This is your last chance to check that appliances are in working condition and that agreed-upon repairs have been made. Here’s a… Continue

Added by Jennifer Griner on August 5, 2010 at 10:39am — No Comments

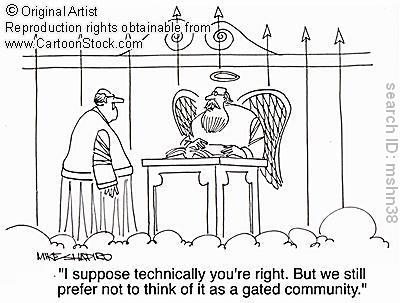

Hump Wednesday Funnies

Click the cartoon above to enlarge.

SMILE! And laugh more! It's GREAT for business and for YOU! Check out… Continue

Added by Jennifer Griner on August 4, 2010 at 10:03am — No Comments

5 Important Factors that Decide Your Credit Score

Credit scores range between 200 and 800, with scores above 620 considered desirable for obtaining a mortgage.

The following factors affect your score:

1. Your payment history.

Did you pay your credit card obligations on time? If they were late, then how late? Bankruptcy filing, liens, and collection activity also impact your history.

2. How much you… Continue

Added by Jennifer Griner on August 3, 2010 at 10:16am — No Comments

A Cup of Inspiration (July 30, 2010)

What counts is not necessarily the size of the dog in the fight - it's the size of the fight in the dog.

- Dwight D. Eisenhower…

Added by Jennifer Griner on July 30, 2010 at 11:44am — No Comments

5 Important Tips When Considering a Short Sale

If you're thinking of selling your home, and you expect that the total amount you owe on your mortgage will be greater than the selling price of your home, you may be facing a short sale. A short sale is one where the net proceeds from the sale won't cover your total mortgage obligation and closing costs, and you don't have other sources of money to cover the deficiency. A short sale is different from a foreclosure, which is when your lender takes title of… Continue

Added by Jennifer Griner on July 29, 2010 at 11:40am — No Comments

6 Creative Ways to Afford a Home

There are still various options to consider when purchasing a home:

1. Investigate local, state, and national down payment assistance programs. These programs give qualified applicants loans or grants to cover all or part of your required down payment. National programs include the Nehemiah program, www.getdownpayment.com, and the American Dream Down Payment Fund from the… Continue

Added by Jennifer Griner on July 27, 2010 at 10:57am — No Comments

How to Recognize a Seller's Market

As a homeowner, and a prospective seller, you may be wondering if now is a good time to put your home on the market.

- But how can you tell if the market is in your favor at this time?

- Will you lose money or make money?

- Is it a "sellers market"?

As a seller, one of the first things you must evaluate is the… Continue

Added by Jennifer Griner on July 26, 2010 at 11:52am — No Comments

A Morning Cup of Inspiration (July 23, 2010)

A determined soul will do more with a rusty monkey wrench than a loafer will accomplish with all the tools in a machine shop.

-Robert Hughes…

Added by Jennifer Griner on July 23, 2010 at 10:03am — No Comments

Hump Wednesday Funnies

There's more to smile about! Check out the Backyard Wealth Funnies collection.

Share the wealth:… Continue

Added by Jennifer Griner on July 21, 2010 at 9:20am — No Comments

Homeowners Take Advantage of the Power and Go Solar

A few years ago, Jim Camasto thought about investing $20,000 in the stock market. But instead, Camasto, of Naperville, Ill., spent that money on a ‘greener’ investment—solar power.

Camasto has installed a solar thermal and solar electricity system on his roof, which helps heat and power his home.

His gas use has dropped more than 50%, and his electricity use has dropped about 70%. He sells extra power back to the…

ContinueAdded by Jennifer Griner on July 21, 2010 at 9:17am — No Comments

Homebuyers: Too Late for Tax Credit Extension, but still Find Market Ripe with Good Deals

A Truly Great Opportunity!

I'm inviting you to the upcoming real estate seminars to discover the many opportunities that exist in the Long Beach, CA market area.

Whether you are a first time buyer or an…

ContinueAdded by Jennifer Griner on July 19, 2010 at 10:15am — No Comments

Homebuyers: Too Late for Tax Credit Extension, but still Find Market Ripe with Good Deals

The three-month homebuyer limited tax-credit extension has helped many people. However, it is too late for other home seekers to take advantage of the tax credit.

But Lucien Salvant, National Association of Realtors spokesperson, says that shouldn't discourage interested buyers because the market is ripe with other opportunity. "The good news for people who didn't take advantage of the tax credit is that the inventory is still… Continue

Added by Jennifer Griner on July 19, 2010 at 9:34am — No Comments

Homebuyers: Find out what you're REALLY paying before you sign for your new home.

Three documents that are crucial to the home buying transaction give both the seller and the buyer a better fix on virtually all costs they can expect to face during the ordeal. This includes everything from the appraisal fee to the underwriter's portion of the title insurance -- as well as a sort of manual to understand how it all works -- the documents make it easier to calculate, compare and question all the costs associated with the… Continue

Added by Jennifer Griner on July 15, 2010 at 10:35am — No Comments

Hump Wednesday Funnies

Comic Artisit: Mark Parisi

Laugh more! Smile more! Check out the Backyard Wealth Funnies collection.

Share the wealth:… Continue

Added by Jennifer Griner on July 14, 2010 at 9:26am — No Comments

Top 5 Answers for Homeowners about Strategic Mortgage Default

1. Should I intentionally default on my home mortgage?

Today, many people are ‘intentionally’ or ‘strategically’ defaulting because cash is more valuable than credit. Because many of the banks were unethical, some borrowers don’t feel the ‘moral obligation’ to pay, especially when the banks are being less than cooperative as buyers try to work things out. Rather than defaulting, the best thing to do is… Continue

Added by Jennifer Griner on July 13, 2010 at 9:21am — No Comments

Mortgage Rates Drop to a New Low

Mortgage rates fell for the second straight week to the lowest point in five decades.

But many people either don’t qualify for new mortgages or have already taken advantage of the low rates this year. As a result, the housing market and the broader economy may not benefit much from the lower rates.

The average rate on a 30-year fixed mortgage dropped to 4.57 percent this week, mortgage company Freddie Mac reported… Continue

Added by Jennifer Griner on July 12, 2010 at 9:17am — No Comments

A Morning Cup of Inspiration (July 9, 2010)

“We are all faced with a series of great opportunities brilliantly disguised as impossible situations.”

- Charles R. Swindoll…

Added by Jennifer Griner on July 9, 2010 at 9:48am — No Comments

Latest Real Estate Investing Blog Posts

- The Road Map to Achieve Your Financial Future

- Government OKs $600 Million in Housing Aid for 5 States

- Low Cost Ways to Spruce Up Your Home Exterior

- Do Not Overlook these Items on a Final Walkthrough

- Hump Wednesday Funnies

- 5 Important Factors that Decide Your Credit Score

- A Cup of Inspiration (July 30, 2010)

Most Popular Blog Posts

© 2024 Created by Matt Gerchow.

Powered by

![]()