May 2010 Blog Posts (32)

Case Shiller Price Observations

Case Shiller Price Observations

The recent Case Shiller report shows price declines in front of the tax credit completion...The index gives us a slight 0.38% decline in the top ten market composite. Year over year the index is up 3.15% when compared to March 09. Recent strong price moves will come to a serious halt because the tax stimulus is behind us. The silver lining in this is that it proves demand is there, just waiting for the right price and for some of this historic uncertainty to settle. This… Continue

Added by Your Property Path on May 28, 2010 at 7:39pm — No Comments

06/14/10 - CTREIA Monthly Meeting with Dave Lindahl - Cromwell, CT

06/14/10 - CTREIA Monthly Meeting with Dave Lindahl - Cromwell, CT

Wealth Advantages Of Apartment Property Investing

June 14 - 5:30 to 9:00 PM

This event takes place on the 2nd Monday this month, so that we could have Dave Lindahl at our meeting. He has made some of

our members financially free and even millionaires by following his

system. Don't miss it.

Crowne Plaza Hotel. 100 Berlin Road. Cromwell, CT

FREE for CTREIA and AOACT members | $30 for… Continue

Added by CTREIA on May 28, 2010 at 11:50am — No Comments

Housing: Where Are We Now

Housing: Where Are We Now

More to Come

Even if the economy stabilizes in 2010 as expected, defaults will remain elevated long afterward. More large payment resets are due to hit… Continue

Added by Your Property Path on May 26, 2010 at 9:34pm — No Comments

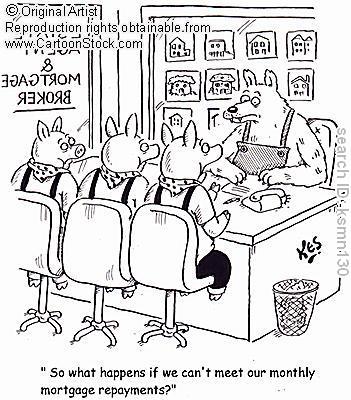

Hump Wednesday Funnies

Hump Wednesday Funnies

Click the comic to enlarge.

Smile more...Smile big! Visit our Backyard Wealth Funnies collection.

Share the wealth:… Continue

Added by Jennifer Griner on May 26, 2010 at 9:19am — No Comments

Plenty of Reasons to Buy a House even after the Tax Credit

Plenty of Reasons to Buy a House even after the Tax Credit

Even though the home buyer tax credit expired on April 30, 2010 and won’t be renewed, there may never be a better time to buy a home than today, according to the National Association of Home Builders (NAHB). Many outstanding opportunities still exist for home buyers, but they may not be around forever.

“The home buyer tax credit was just one of many factors motivating Americans to buy homes,” said NAHB Chairman Bob Jones, a builder and developer… Continue

Added by Jennifer Griner on May 26, 2010 at 9:19am — No Comments

Buying vs. Renting in this Market - Calculate which makes sense for you

Buying vs. Renting in this Market - Calculate which makes sense for you

The buy-versus-rent question is particularly relevant right now. To qualify for an expiring federal tax credit of up to $8,000, home buyers must sign a contract by April 30 and close on the house by June 30. Many economists also expect mortgage rates to rise in coming months.

Camela Witters, a 38-year-old trophy engraver in Las Vegas, plans to close on her first home purchase — a four-bedroom, $164,000 house nearly… Continue

Added by Jennifer Griner on May 24, 2010 at 9:57am — No Comments

Buying Real Estate in Mexico now! A wise thing to do.

Buying Real Estate in Mexico now! A wise thing to do.

Added by Heidi Wosak on May 22, 2010 at 12:18pm — No Comments

Now is Still a Good Time to Buy?

Now is Still a Good Time to Buy?

More than 80% of first-time home buyers and sellers feel the current housing market is more affordable today than this time last year, despite the fact that 40% of all respondents are more worried about the economy compared to this time last year, according to Century 21 Real Estate LLC's First-Time Home Buyers and Sellers Survey.

While the attractive combination of home prices, mortgage rates and tax credits appeal to both buyers and sellers,… Continue

Added by Jennifer Griner on May 20, 2010 at 1:40pm — No Comments

05/27/10 - Fairfield County Real Estate Investors Meeting - Bridgeport, CT

05/27/10 - Fairfield County Real Estate Investors Meeting - Bridgeport, CT

(in association with the

Bridgeport Downtown Task Force)

Bridgeport’s New Development Toolbox: Opportunities for Development with Bridgeport’s New Master Plan and Zoning Regulations

Thursday, May 27. 8:00 – 11:00 am

Golden Hill…

Added by CTREIA on May 20, 2010 at 11:33am — No Comments

BAM! BPO Automation Makeover

BAM! BPO Automation Makeover

Hey, it's almost summer, and BPO Automation is kicking it off with a complete website makeover: new videos, graphics, & online goodies.....and it comes just in time for our summer launch of all new product enhancements to help you "Get More Orders & Finish Them Faster!"

Hey, it's almost summer, and BPO Automation is kicking it off with a complete website makeover: new videos, graphics, & online goodies.....and it comes just in time for our summer launch of all new product enhancements to help you "Get More Orders & Finish Them Faster!"

Our BPO form-completion software has remains #1 in today's competitive marketplace because we're always…

ContinueAdded by Tim Ventura on May 19, 2010 at 2:41pm — No Comments

Hump Wednesday Funnies

Hump Wednesday Funnies

Added by Jennifer Griner on May 19, 2010 at 9:11am — No Comments

Home Buyers Tax Credit Extended for Armed Service Members

Home Buyers Tax Credit Extended for Armed Service Members

The expiration date of the $8,000 first-time home buyer may have already passed for most, but there are some potential homebuyers who can still take advantage of this great opportunity.

For those who are qualified service members, you have an extra year to cash in on the credit. Your new deadline is April 30, 2011. The government defines "qualified service member" as a member of the uniformed services of the U.S military, a member of the Foreign… Continue

Added by Jennifer Griner on May 18, 2010 at 9:35am — No Comments

10 Important Tips After Bankruptcy

10 Important Tips After Bankruptcy

One common problem people emerging from bankruptcy often face is the negative, long-term impact it has on their ability to be approved for new credit at a reasonable cost. Many creditors will not lend to you for one to two years. When you finally begin to qualify again, you will typically be categorized as “extra high risk,” which often is accompanied by lower credit limits and very high… Continue

Added by Jennifer Griner on May 17, 2010 at 9:43am — No Comments

A Cup of Inspiration (May 14, 2010)

A Cup of Inspiration (May 14, 2010)

Thomas Edison dreamed of a lamp that could be operated by electricity, began where he stood to put his dream into action, and despite more than ten thousand failures, he stood by that dream until he made it a physical reality.

Practical dreamers do not…

ContinueAdded by Jennifer Griner on May 14, 2010 at 11:36am — No Comments

Mortgage Bankers Weekly Update: Mortgage Applications Drop

Mortgage Bankers Weekly Update: Mortgage Applications Drop

Refinance Index: increased 14.8 percent from the previous week and the… Continue

Added by Your Property Path on May 13, 2010 at 7:04pm — No Comments

Freddie Mac Weekly Mortgage Update: Lowest Level Of The Year

Freddie Mac Weekly Mortgage Update: Lowest Level Of The Year

30-year fixed-rate mortgage: Averaged 4.93 percent with an average 0.7 point for the week ending May 13, 2010, down from last week when it averaged 5.00 percent. Last year at this time, the 30-year FRM averaged 4.86 percent. The 30-year FRM has not been lower since the week ending December 10, 2009, when it averaged 4.81 percent.

The 15-year fixed-rate mortgage:… Continue

Added by Your Property Path on May 13, 2010 at 7:03pm — No Comments

How to Partner with Sellers to Make More Money

How to Partner with Sellers to Make More Money

One of the most exciting advantage of real estate investing is the number of creative ways to make a transaction or a "real estate deal" lucrative for you and, better yet, for all parties involved.

The important questions to ask yourself before jumping in:

1. How creative are you?

2. How bad do you need the deal?

3. How motivated are your Sellers to sell?

Your goal here is to partner with the seller, assume… Continue

Added by Jennifer Griner on May 13, 2010 at 9:26am — No Comments

Hump Wednesday Funnies

Hump Wednesday Funnies

Added by Jennifer Griner on May 12, 2010 at 9:12am — No Comments

10 Big Mistakes to Avoid When Investing in Real Estate

10 Big Mistakes to Avoid When Investing in Real Estate

Once the real-estate market starts to rebound, investing in property will become a more appealing idea -- either as a career or a great side job. Like any other endeavor, though, there's a right way and a wrong way to go about it.

Bankrate spoke with established, full-time real-estate investors and with professionals, such as bankers, to identify the 10 types of traps into which… Continue

Added by Jennifer Griner on May 11, 2010 at 10:38am — No Comments

The New Alternative to Foreclosures

The New Alternative to Foreclosures

In an effort to stem the growing tide of mortgage loan defaults across the country, the federal government has come up with yet another alternative: a deed in lieu of foreclosure agreement (DIL).

The DIL offers another option to homeowners who are unable to complete a short sale or who don't qualify for… Continue

Added by Jennifer Griner on May 10, 2010 at 11:33am — No Comments

Featured Real Estate Investing Blog Posts

Latest Real Estate Investing Blog Posts

Most Popular Blog Posts

- The Rules of Canadian Real Estate Investing

- FHA guidelines for conversion of primary residence to rental property

- Turning Houses Into Private Assisted Living Facilities

- Freddie Mac Weekly Update: Mortgage Rates Stable

- Now is a Great Time to Buy

- Tips and Secrets On RealEstate Investing

- 6 Essentials to PreQualify for a Home Loan

Monthly Archives

2013

2012

- December (6)

- November (5)

- October (3)

- September (8)

- August (7)

- July (4)

- June (6)

- May (9)

- April (4)

- March (1)

- February (2)

- January (2)

2011

- December (2)

- November (1)

- September (6)

- August (12)

- July (7)

- June (5)

- May (7)

- April (5)

- March (5)

- February (19)

- January (10)

2010

- December (9)

- November (11)

- October (6)

- September (4)

- August (19)

- July (28)

- June (33)

- May (34)

- April (37)

- March (41)

- February (39)

- January (42)

2009

- December (33)

- November (43)

- October (46)

- September (17)

- August (12)

- July (5)

- June (17)

- May (7)

- April (6)

- March (8)

- February (12)

- January (6)

2008

© 2024 Created by Matt Gerchow.

Powered by

![]()